Anonymous Gold Buying: Your Complete Guide to Private Metal Investments

North America dominates the world’s bitcoin ATM landscape with 88.9% of all installations. This makes anonymous gold buying more available than ever before to American investors.

Gold stands strong as a trusted safe-haven asset in 2024. Bitcoin has grown into a popular digital investment choice alongside it. These two investment options now join together to create new opportunities for privacy-conscious investors who want to vary their portfolios. Our team at BitGolder specializes in anonymous gold purchases with cryptocurrency. Nearly 4,000 satisfied customers have given us a remarkable 4.8/5 rating.

You can buy gold anonymously without any security compromises. Quick and secure purchases up to $20,000 are possible on our platform with no KYC requirements. We support multiple cryptocurrencies including Bitcoin, Ethereum, and stablecoins to help you invest in precious metals.

This detailed piece will show you everything about no-KYC gold purchases. You’ll learn what anonymous gold truly means and how to make your first private metal investment with confidence.

What Does Buying Gold Anonymously Really Mean?

“Commodities such as gold and silver have a world market that transcends national borders, politics, religions, and race.” — Robert Kiyosaki, Author of ‘Rich Dad Poor Dad’, prominent financial educator

New investors often misunderstand what anonymous gold buying really means. Each jurisdiction has its own rules and limitations about buying gold without identification.

How anonymous gold is different from regular purchases

Anonymous gold transactions need less documentation than standard purchases. Physical gold doesn’t leave a digital footprint like other financial assets, which makes it perfect for private ownership. Many investors choose gold because of this unique, discrete quality.

Truly anonymous purchases face more restrictions now. Germany has cut its anonymous purchase limit from €15,000 to €10,000, and since January 2020, it’s down to just €2,000. European dealers let customers buy up to €10,000 once a month without named invoices.

BitGolder stands out by letting customers make no-KYC gold purchases up to $20,000 with cryptocurrency. This limit is much higher than what traditional dealers can offer as they must follow stricter regulations.

Common myths about anonymous gold buying

People hold several mistaken beliefs about anonymous gold purchasing:

- Myth: Complete anonymity is achievable: You can’t buy gold without leaving any trace these days. Rules keep getting tighter as authorities work to stop money laundering and terrorist financing.

- Myth: Cash guarantees anonymity: Cash payments used to be untraceable, but now most countries need ID even for small cash transactions.

- Myth: Gold is untraceable: Modern gold bars and coins come with numbers and registration, which lets authorities track them when needed.

- Myth: Anonymous gold is always illegal: Laws vary by country. France bans anonymous gold purchases completely, while other countries allow transactions under certain limits without ID on invoices.

Rules keep changing and usually become stricter as governments add new anti-money laundering rules.

Why privacy matters in precious metal investments

Responsible investors benefit from private gold ownership in several ways. Storing gold offshore protects you from strict financial regulations at home. Gold’s physical nature helps in discrete estate planning, so wealthy individuals can pass assets to their heirs privately.

Private ownership also protects legitimate investors from unwanted attention. Physical gold stored properly doesn’t advertise your wealth like bank accounts or digital assets do. This privacy is why investors choose platforms like BitGolder that protect their privacy while following the law.

Physical gold and BitGolder’s cryptocurrency payment options give privacy-focused investors a great chance to invest discreetly. BitGolder accepts Bitcoin and other cryptocurrencies to offer transaction privacy you can’t get through regular banks, all while staying within legal limits.

Anonymous gold buying isn’t about hiding illegal activity. It’s a discrete way to preserve wealth that values privacy without breaking financial rules.

Step-by-Step: How to Buy Gold Anonymously with Crypto

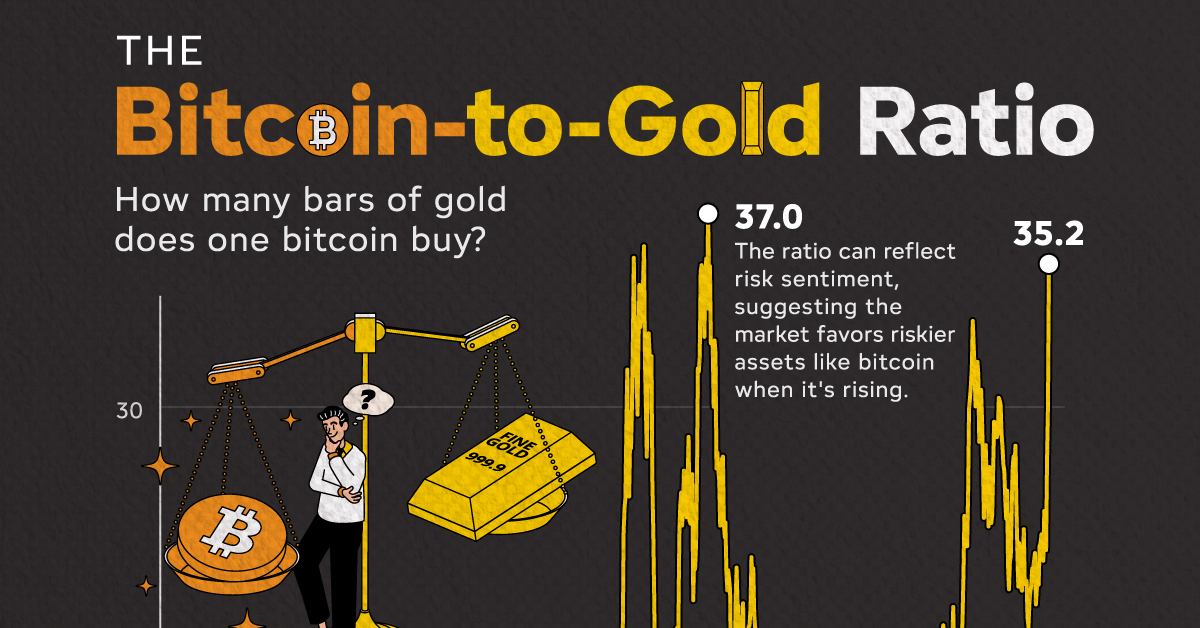

Image Source: Visual Capitalist

Buying gold with cryptocurrency is a quick way to keep your precious metals investments private. Here’s how you can do this in five simple steps.

1. Choose a no-KYC gold dealer like BitGolder

Your path to anonymous gold ownership starts with picking a dealer that values your privacy. BitGolder lets you buy up to $20,000 worth of gold without ID. This is a big deal as it means that their limit is higher than other dealers, making them perfect for investors who want privacy.

Check the dealer’s reputation and their dedication to privacy before you decide. BitGolder has delivered thousands of orders since 2013, proving their reliability in the anonymous gold market.

2. Set up a secure crypto wallet

You’ll need a cryptocurrency wallet to store and move your digital assets before you buy gold anonymously. Hardware wallets like Ledger and Trezor give you better security, while Coinbase, Blockchain, and BitPay are more convenient options.

Exodus works best for privacy as you can use it on computers and phones. Setup is quick – just go to their website, download your version, and follow their guide.

3. Select your gold products

Your next step is browsing through gold products once your wallet is set up. BitGolder has gold bars and coins. Look at prices carefully and check for any discounts.

Physical gold is a chance for privacy-focused investors since it doesn’t leave digital footprints.

4. Pay with Bitcoin or Monero

BitGolder takes several cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Monero (XMR)

- Ripple (XRP)

- Dash (DASH)

Monero (XMR) gives you the most privacy since it’s built for anonymity. Bitcoin remains popular, but you might want to use privacy tools like CoinJoin or Lightning Network to keep your transactions more private.

Payment is simple. Pick your payment method, go to the payment page where you’ll see a QR code and wallet address, then send the exact amount shown. BitGolder uses secure payment systems like CoinPayments.net and BTC Pay to keep your transaction private and reliable.

5. Choose delivery or vault storage

Your last choice is how to get your gold. BitGolder gives you two options:

Secure Delivery: They’ll send your gold in discreet packaging with full insurance. BitGolder’s shipping system has moved over 50,000 gold and silver parcels safely. Keep an eye on your tracking until delivery.

Vault Storage: You might prefer secure vault storage in places with strong privacy laws. This option removes delivery worries and helps keep your gold completely private.

After your payment goes through, you’ll get two emails: one confirms your payment with a transaction ID, and another tells you about your order and delivery time.

These five steps help you buy precious metals while keeping your privacy intact. BitGolder’s mix of no-KYC rules, multiple crypto options, and secure delivery makes them the top choice for anonymous gold investments.

Privacy Tools and Techniques for Anonymous Gold Buying

Image Source: Ulam Labs

Privacy-minded investors need tools and techniques to stay anonymous while buying precious metals. BitGolder has become the most trusted platform to buy gold anonymously. They understand and support these vital privacy practices.

Using privacy coins like Monero

Monero leads the way in anonymous payments and offers complete privacy by design. Bitcoin shows all transactions on its ledger, but Monero keeps them private. No one can see transaction details or user identities. This cryptocurrency uses several advanced privacy features:

- RingCT technology hides transaction amounts

- Stealth addresses create one-time addresses for each transaction

- Ring signatures mask sender identity

Buying gold through BitGolder with Monero adds an extra layer of privacy protection. The platform makes this simple. You select products, go to checkout, and send XMR to the provided wallet address.

How CoinJoin and Lightning Network help

Bitcoin users can boost their privacy with specialized tools. CoinJoin breaks the links between addresses that could identify users. It combines multiple transactions with similar UTXO values. This makes it impossible to match inputs with outputs.

Lightning Network gives users another privacy option. This “layer 2” solution handles Bitcoin transactions off-chain. These transactions are:

- Much faster than main blockchain transfers

- More private than regular Bitcoin payments

- Better for energy consumption

BitGolder lets you pay through Lightning Network. Bitcoin users keep their privacy without switching cryptocurrencies. This shows their steadfast dedication to giving customers different privacy options.

Avoiding address reuse and IP leaks

Many people overlook address reuse in cryptocurrency privacy. Using the same Bitcoin address multiple times puts your privacy at risk. It creates a permanent trail on the blockchain. Each reuse links all past and future transactions. This could expose personal details and spending habits.

You can maximize privacy while buying gold from BitGolder:

- Create a new address for every transaction

- Use Tor browser to stop IP leaks

- Keep separate wallets for different uses

Address reuse makes it easier for bad actors to find and identify users. This could lead to identity theft or targeted attacks. New addresses for each transaction protect your financial activities. You stay in control of your digital assets.

BitGolder works great for investors who want to own gold anonymously. Their platform supports these privacy tools and gives you a smooth buying experience.

Legal and Tax Considerations You Should Know

“Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort.” — Antony C. Sutton, British-American economist and historian

Gold buyers need to understand the rules about anonymous purchases, which differ across countries. This knowledge helps both experienced investors and newcomers make better decisions.

KYC and AML laws explained

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are the life-blood of financial compliance worldwide. Precious metals dealers with annual business over $50,000 must implement detailed verification programs. These dealers must verify customer identities, keep transaction records, and report any suspicious activities.

Most traditional gold dealers need to collect your personal information and create a permanent record of your purchase. These requirements help prevent money laundering and terrorism financing. Financial institutions stand as the first defense against illegal activities.

Can you buy gold anonymously legally?

The rules for anonymous gold purchases vary by country. French law banned anonymous gold buying in 2014. Other European countries set different limits. Dutch dealers let customers buy gold anonymously with cash up to €10,000.

BitGolder offers a solution with their compliant system. Users can buy gold anonymously up to $20,000 without KYC requirements. Their platform accepts cryptocurrency payments within legal boundaries while protecting customer privacy. This makes them the most trusted choice for no-ID gold purchases.

Tax events when trading crypto for gold

Trading cryptocurrency for physical gold creates tax obligations you need to know about. Many countries treat this exchange as a taxable event that realizes your cryptocurrency gains or losses.

Good documentation matters when you sell gold later. Missing purchase records might lead to higher tax rates. French authorities charge about 11.5% precious metals tax on sales without proof of purchase date and price.

BitGolder makes this easier. Their platform gives you all needed documents while protecting your privacy. You stay compliant without giving up anonymity.

Why BitGolder Is the Best Platform for No-KYC Gold

BitGolder has been around for 5 years with more than 500 positive reviews on CoinPayments and Trustpilot. The platform has become the go-to choice for anonymous gold investments.

No ID gold purchases up to $20,000

BitGolder stands out from its competitors by letting you buy gold without ID for up to $20,000. This is a big deal as it means that their limit is much higher than other dealers, making it perfect for investors who value their privacy. You can place small orders without creating an account, which gives you both convenience and privacy.

Anonymous shipping and secure packaging

Security is at the heart of BitGolder’s operations. The company records every step of the packaging process and uses secret codes to encrypt packages. You’ll get package weight details to verify before delivery. The company ships worldwide using discreet packaging that keeps contents hidden and safe. You can choose to have your order delivered to your home or pick it up from offices in Baarn or The Hague.

Certificates of authenticity and refund policy

The best part about BitGolder is their 100% refund guarantee that works every time, no questions asked if delivery fails. This shows how confident they are in their shipping methods. Every gold bar and coin comes with proper authentication, and they guarantee to buy back precious metals at current market rates.

BitGolder accepts many cryptocurrencies like Bitcoin, Ethereum, Monero, and various stablecoins across networks such as Arbitrum, Base, and Tron.

Conclusion

Smart investors who want to broaden their portfolios with precious metals care deeply about privacy and security. In this piece, we explore how buying gold anonymously helps protect your financial privacy while investing in real assets.

BitGolder emerges as the most trusted platform to buy gold anonymously using cryptocurrency. Their $20,000 no-KYC threshold is a big deal as it means that you can make substantial investments without sharing personal details. On top of that, it accepts multiple cryptocurrencies like Bitcoin, Ethereum, and privacy-focused Monero to give investors more flexibility.

The platform uses videotaped packaging, encrypted packages with secret codes, and discreet shipping. These features explain why thousands of customers rate BitGolder so highly. A 100% refund guarantee and buyback program remove typical worries about buying precious metals remotely.

Buying gold anonymously doesn’t mean breaking any laws. This legitimate approach to wealth preservation protects your privacy while following applicable regulations. BitGolder has struck this balance since 2013.

Cryptocurrency and precious metals join to create new possibilities for privacy-focused investors. BitGolder’s simple process makes anonymous gold investing available to everyone – from beginners to seasoned investors. You can choose secure home delivery or vault storage.

Note that while complete anonymity is harder to achieve in today’s regulatory climate, platforms like BitGolder provide more privacy than traditional dealers. Their mix of cryptocurrency payments, strong security protocols, and steadfast dedication to customer confidentiality makes them the best choice for serious private gold investors.

Key Takeaways

Anonymous gold buying with cryptocurrency offers privacy-conscious investors a legitimate path to precious metal ownership while maintaining discretion and security.

• BitGolder enables no-KYC gold purchases up to $20,000 using Bitcoin, Ethereum, Monero, and other cryptocurrencies without identity verification requirements.

• Use privacy coins like Monero for maximum anonymity when buying gold, as they offer complete transaction privacy unlike Bitcoin’s transparent ledger.

• Anonymous gold buying remains legal in many jurisdictions with specific thresholds, though regulations vary significantly by country and continue evolving.

• Cryptocurrency-to-gold exchanges create taxable events in most jurisdictions, so maintain proper documentation for compliance while preserving privacy.

• Choose secure delivery or vault storage options with established dealers who provide authentication certificates, insurance, and buyback guarantees for peace of mind.

The key to successful anonymous gold investing lies in understanding both the privacy tools available and the legal frameworks governing precious metal purchases. BitGolder’s combination of high no-KYC limits, multiple cryptocurrency options, and proven security measures makes it the premier choice for investors seeking to diversify into physical gold while maintaining financial privacy.

FAQs

Q1. Is it possible to buy gold anonymously? Yes, it is possible to buy gold anonymously through certain platforms that offer no-KYC (Know Your Customer) purchases. Some dealers, like BitGolder, allow anonymous gold purchases up to $20,000 using cryptocurrencies without requiring identification.

Q2. What are the advantages of buying gold anonymously? Buying gold anonymously offers several benefits, including enhanced privacy, protection from domestic scrutiny, discrete estate planning, and safeguarding against potential threats. It allows investors to preserve wealth without broadcasting their financial status.

Q3. How can I ensure maximum privacy when buying gold with cryptocurrency? To maximize privacy, consider using privacy-focused cryptocurrencies like Monero, employing CoinJoin or Lightning Network for Bitcoin transactions, avoiding address reuse, and using tools like Tor browser to prevent IP leaks. Choose a reputable no-KYC dealer that prioritizes customer privacy.

Q4. Are there legal implications to buying gold anonymously? The legality of anonymous gold purchases varies by jurisdiction. While some countries have strict regulations, others allow purchases up to certain thresholds without requiring identification. It’s important to understand and comply with local laws and tax obligations when buying gold anonymously.

Q5. What security measures should I look for when buying gold anonymously online? When buying gold anonymously online, look for dealers that offer secure packaging, discreet shipping, video-recorded packaging processes, and package weight verification. Additionally, ensure the dealer provides certificates of authenticity, insurance, and a clear refund or buyback policy for peace of mind.