Why People Buying Gold With Bitcoin This Black Friday 2025

Gold Black Friday 2025 arrives at a time of significant economic change as the dollar has lost more than 10% of its value this year. The U.S. Dollar Index faces its worst half-year stretch in 50 years, and Bitcoin has surged past $126K. This connection makes sense – hard assets usually rise as the greenback falls.

The crypto market’s total value now reaches $3.37 trillion. Many investors now check crypto Black Friday deals that let them turn digital gains into real assets. The list of items you can buy with cryptocurrency keeps growing, and it includes gold coins and bars. The dollar’s portion of global reserves has dropped to a 30-year low at 56%. Smart investors use platforms like Bitgolder to turn their Bitcoin into gold during these seasonal sales. They get the best of both assets and take advantage of special deals. The whole process works just like a debit card, making this Black Friday a perfect time to broaden into precious metals.

Why the Dollar Is Weakening in 2025

Image Source: SoSoValue

The US dollar has lost about 11% of its value in the first half of 2025, marking its steepest decline in 50 years. Investors now see a perfect chance to buy gold during Black Friday deals as a safeguard against unstable fiat currencies.

Rising inflation and interest rate uncertainty

Core inflation will likely exceed 3% by late 2025, despite the Fed’s efforts to stabilize the economy. Economists now describe the current situation as “stagflation-lite” because new tariffs have created a mix of slow growth and steadily rising prices.

The Federal Reserve must walk a tightrope now. US growth could slow down to just 1% in 2026. Interest rates might drop from the current 5.25%-5.5% to as low as 2.5% by next year’s end. This uncertainty has led more investors to services like Bitgolder. Many want to exchange their volatile cryptocurrencies for gold coins and bars before Black Friday sales begin.

Global shift away from USD reserves

The dollar’s dominance in global reserves has dropped from its 72% peak in 2001 to about 56% today. Central banks worldwide now prefer a more diverse portfolio, and gold stands out as their top choice.

Central banks in emerging markets have shown strong interest in gold. Their gold reserves have grown from 4% to 9% in the last decade. Crypto investors see this trend as a signal to convert some Bitcoin to physical gold through upcoming Black Friday deals.

Impact of geopolitical tensions on fiat trust

Questions about US economic stability and fiscal outlook have emerged due to policy uncertainties. Traditional currency systems face growing skepticism amid global conflicts and trade disputes.

Geopolitical uncertainty has changed how companies and countries behave. Businesses have cut capital spending while countries deal with stricter credit terms. This situation makes holding both cryptocurrency and gold more appealing. Black Friday gold coin deals now provide cheaper entry points for investors interested in this strategy.

Why Bitcoin and Gold Are Winning Assets Right Now

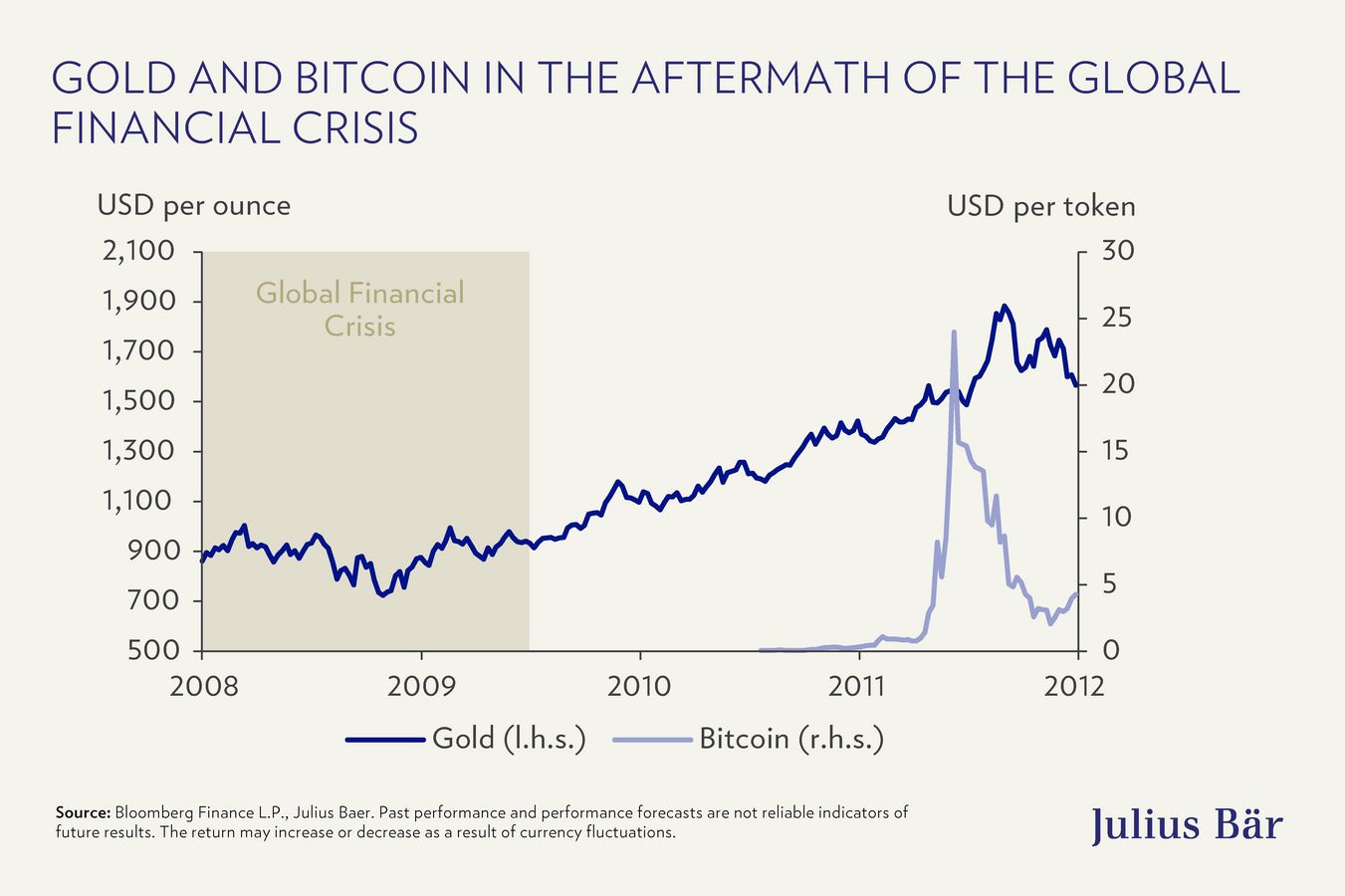

Image Source: Julius Baer

Bitcoin and gold have soared to record heights in October 2025. Investors worldwide now see these assets as powerful shields against economic uncertainty. The cryptocurrency has surged past $126,000 while gold crossed the $4,000 per ounce threshold – creating a chance for wealth preservation.

Bitcoin as digital gold: a hedge against inflation

The “digital gold” nickname fits Bitcoin perfectly due to its absolute rarity – only 21 million bitcoins can ever exist, with 19.9 million already circulating. This limited supply makes Bitcoin a potential shield against fiat currencies losing value. Research has proven Bitcoin’s ability to rise during inflation shocks, which many investors suspected all along.

JPMorgan Chase believes Bitcoin remains nowhere near its true value compared to gold and could reach $165,000 by year-end 2025. Bitgolder helps investors by offering continuous Bitcoin-to-gold conversions with exclusive Black Friday discounts on gold coins and bars.

Gold’s historical role in economic downturns

Gold shows its reliability time and again. It has outperformed all major U.S. equity market indexes year-to-date and over one-year and three-year periods. This remarkable performance matches gold’s pattern of excellence during economic stress.

Central banks worldwide plan to buy approximately 900 tons of gold in 2025. This shows their confidence in the metal’s stability. Gold’s near-zero long-term correlation with equities gives investors true portfolio diversification – which explains why Bitgolder’s Black Friday gold offers have drawn much attention.

How traders are rotating capital into hard assets

Analysts call it “the debasement trade” – a calculated bet that government borrowing and money printing will keep eroding the dollar’s value. Investors now flock to assets outside traditional financial systems.

Billionaire Paul Tudor Jones suggested owning a mix of gold, cryptocurrencies, and tech stocks through year-end. This shift toward hard assets gains momentum as real yields compress – a powerful catalyst for precious metals throughout history.

Bitgolder stands out this Black Friday by making this strategy simple. Their platform lets investors maintain exposure to both digital and physical gold with exceptional seasonal pricing.

Top 5 Reasons Smart Investors Are Buying Gold With Bitcoin This Black Friday

The debasement trade continues to pick up speed as smart investors look for financial safety. Here are five key reasons why more people are converting their Bitcoin to gold this Black Friday:

1. Hedge against fiat currency devaluation

The dollar has dropped 8% this year, which pushed gold to 41 record highs in 2025. This connection makes perfect sense – investors see both Bitcoin and gold as strong protection against weakening fiat currencies. Converting cryptocurrency to physical gold helps investors keep their purchasing power while national currencies lose value through ongoing inflation and high government deficits.

2. Take advantage of crypto black Friday deals

Last year’s crypto Black Friday broke records with US online sales hitting $10.8 billion. This year’s special offers include major discounts on hardware wallets, trading platforms, and gold conversion services. Bitgolder’s Black Friday deal cuts their competitive 0.6% Bitcoin transaction fee even further. November proves to be the perfect time to move wealth into precious metals.

3. Diversify with tangible assets like gold bars and coins

Financial advisors suggest putting 5-25% of net worth into precious metals. Gold bars serve as high-weight, pure investments, while government-minted coins provide both investment and collector’s value. New buyers typically start with gold rounds – privately minted pieces that offer gold content without the collector coin premium.

4. Use gains from Bitcoin’s 2025 rally

Bitcoin’s price recently topped $125,000. JPMorgan projects potential growth to $165,000. Smart investors now convert some of their profits to gold. This strategy secures their gains and balances Bitcoin’s volatility with gold’s stability.

5. Use platforms like Bitgolder for smooth transactions

Bitgolder, a 6-year-old platform, offers a detailed solution to convert cryptocurrency into physical gold. Their system works with Bitcoin, Ethereum, stablecoins, and other cryptocurrencies across multiple networks. The platform provides private shipping options for orders up to $20,000. They also use strong security measures including videotaped packaging and encrypted packages.

How Bitgolder Makes Bitcoin-to-Gold Easy and Secure

Image Source: CryptoNinjas

Bitgolder leads the market as the go-to platform to convert digital assets into physical precious metals. This 4-year old European gold retailer serves over 20,000 happy customers.

Overview of Bitgolder’s platform

The platform’s user-friendly design helps newcomers buy gold with cryptocurrency easily. EU customers can expect their orders to ship within one business day.

Supported cryptocurrencies and gold products

Bitgolder accepts many digital currencies: Bitcoin, Ethereum, Litecoin, Monero, Ripple, and Dash. The platform supports multiple blockchain networks like Arbitrum, Base, and Tron. Their catalog includes world-renowned coins like American Gold Eagles and Canadian Gold Maple Leafs among other gold bars from 1g to 1kg.

Security, storage, and delivery options

The platform’s reliable security measures protect every transaction. Staff records each packaging process on video, encrypts packages with secret codes, and includes weight details for delivery verification. Customers can buy up to $20,000 worth of gold without identity verification.

Why Bitgolder stands out during Black Friday 2025

Bitgolder’s competitive fees make it an excellent choice this Black Friday – just 0.6% for Bitcoin and 0.8% for Ethereum and stablecoins. Their 100% refund guarantee will give a risk-free buying experience.

Conclusion

The economic landscape of 2025 shows how pairing Bitcoin with gold has become a smart investment strategy. This piece explores the dollar’s historic 11% drop that pushed Bitcoin above $126,000 and gold past $4,000 per ounce. These parallel rises confirm what financial experts have been saying – hard assets thrive as fiat currencies weaken.

Black Friday 2025 gives investors a great chance to act, especially when you have platforms like Bitgolder offering special deals on gold purchases with crypto. Bitgolder’s easy-to-use interface comes with detailed security protocols and low transaction fees of 0.6% for Bitcoin conversions. On top of that, it offers a wide selection of internationally recognized gold coins and bars to vary your holdings.

Numbers tell the story – central banks worldwide have cut their dollar reserves while adding more gold. JPMorgan sees Bitcoin reaching $165,000 by year-end. Converting some crypto gains into physical gold through Bitgolder’s Black Friday deals makes sense to preserve wealth.

Bitgolder makes buying gold easier than traditional methods. The platform processes orders quickly, accepts various cryptocurrencies, and ships discreetly. Their no-ID-required policy for orders under $20,000 appeals to investors who want to protect their wealth outside the regular financial system.

Black Friday 2025 brings together weakening fiat currencies, rising alternative assets, and seasonal gold conversion discounts. Bitgolder offers the quickest way to bridge these digital and physical stores of value. This Black Friday could be your chance to secure a financial future with both Bitcoin and gold.

Key Takeaways

Smart investors are capitalizing on the dollar’s historic 11% decline by converting Bitcoin gains into physical gold during Black Friday 2025, creating a powerful hedge against economic uncertainty.

• Dollar weakness drives hard asset demand: The USD has hit a 30-year low in global reserves at 56%, pushing Bitcoin past $126K and gold above $4,000/oz.

• Black Friday offers optimal conversion timing: Platforms like Bitgolder reduce transaction fees during seasonal sales, making Bitcoin-to-gold conversions more cost-effective.

• Diversification through dual-asset strategy: Combining Bitcoin’s digital scarcity with gold’s historical stability provides protection against both inflation and market volatility.

• Seamless crypto-to-gold transactions: Modern platforms accept multiple cryptocurrencies with fees as low as 0.6% and offer anonymous shipping for orders under $20,000.

• Central banks validate the trend: Institutional gold purchases projected at 900 tons in 2025 confirm professional confidence in precious metals during currency debasement.

This convergence of weakening fiat currencies, record-high alternative assets, and seasonal discounts creates an unprecedented opportunity for wealth preservation through strategic asset allocation.

FAQs

Q1. How does the relationship between Bitcoin and gold prices typically work? While Bitcoin and gold are both considered alternative assets, their price movements are not always directly correlated. Generally, both tend to perform well during periods of economic uncertainty or when fiat currencies weaken. However, their individual price dynamics can differ based on various market factors and investor sentiment.

Q2. What are the advantages of buying gold with Bitcoin during Black Friday? Purchasing gold with Bitcoin during Black Friday can offer several benefits. You can take advantage of seasonal discounts on gold products, potentially get reduced transaction fees on crypto-to-gold conversions, and diversify your investment portfolio by combining digital and physical assets. It’s also an opportunity to secure some of your cryptocurrency gains in a tangible, historically stable asset.

Q3. How does Bitgolder ensure the security of Bitcoin-to-gold transactions? Bitgolder employs multiple security measures to protect transactions. These include videotaping the packaging process, encrypting packages with secret codes, and providing weight information for verification upon delivery. They also offer anonymous shipping for orders under $20,000 and use robust encryption for all online transactions.

Q4. What types of gold products can be purchased using Bitcoin? Through platforms like Bitgolder, you can purchase a wide range of gold products using Bitcoin. These typically include internationally recognized gold coins such as American Gold Eagles and Canadian Gold Maple Leafs, as well as gold bars in various sizes ranging from 1 gram to 1 kilogram.

Q5. Why are central banks increasing their gold reserves? Central banks are increasing their gold reserves as part of a broader strategy to diversify away from traditional fiat currency holdings, particularly the US dollar. Gold is seen as a hedge against inflation, currency fluctuations, and geopolitical uncertainties. This trend reflects growing concerns about the long-term stability of fiat currencies and the global financial system.