Physical Gold vs ETF: The Truth About Which Makes More Money

Gold prices have hit record highs multiple times this year. The choice between physical gold and ETFs has become more significant than ever. Investors need to understand their options clearly as they plan their investment strategy for 2025.

The precious metal has proven its worth as a reliable safe haven. It has delivered an impressive 11% CAGR over the last 25 years. Physical gold gives you tangible assets you can hold in your hand. Digital gold lets you own the metal through electronic platforms. Digital gold investment provides an economical starting point. You can begin with as little as INR 100. Both options come with their own fee structures.

This piece will help you figure out which option might yield better returns in 2025. We’ll head over to the advantages and drawbacks of paper gold vs physical gold. You’ll learn about the best physical gold options if that’s your preferred choice. The guide also takes a quick look at services like Bitgolder. These platforms let investors convert cryptocurrency into gold bullion to vary their investment across multiple asset classes.

What is physical gold and how does it work?

Image Source: Investing News Network

Physical gold stands apart from paper assets as real wealth you can hold in your hands. You don’t need any financial middleman or counterparty to own this precious metal. It works as a value store and gives investors peace of mind when the economy looks shaky.

Forms of physical gold: coins, bars, and jewelry

You’ll find physical gold in three main forms, each with its own investment features:

Gold Bullion Bars are the quickest way to buy gold by weight. These bars are at least 99.5% pure gold and come in sizes from 1 gram to 1 kilogram. Their weight-to-value ratio makes storage a breeze.

Gold Coins like American Gold Eagles, Canadian Maple Leafs, and South African Krugerrands come with government backing and distinctive designs. Investors love that these coins mix pure gold content with collector appeal. But they cost more than bars because of production expenses.

Gold Jewelry doubles as both decoration and investment. Pieces with higher karat marks (18K and above) pack more precious metal and hold their value better. In spite of that, jewelry markups can hit 100% above wholesale prices.

Best physical gold to buy for investment

Smart investors stick to prominent, easy-to-sell products to keep risks low. American Gold Eagles and gold bars from trusted refiners like MKS PAMP are easy to resell without huge markups.

Smaller coins (1/10-ounce, ¼-ounce) let you invest without saving up too much, though they cost a bit more than full-ounce ones. Private mint gold coins are great value for money and cost less than government-issued ones.

Is physical gold a good investment in 2025?

Physical gold acts more like financial insurance than just another investment. Recent market shake-ups have pushed many investors toward real assets outside the usual financial system.

Bitgolder and similar services now let you turn cryptocurrency into physical gold bullion if you want to broaden beyond traditional gold investments.

Note that owning physical gold means thinking about more than just the purchase price – you need safe storage and should know about selling challenges. Still, gold’s track record during tough economic times keeps drawing investors who want to protect their wealth.

Understanding gold ETFs and how they function

Gold ETFs have become a popular choice for investors who want exposure to precious metals without dealing with physical gold storage. These financial tools have reshaped how people invest in the gold market since they first appeared.

What is a gold ETF?

Gold ETFs are exchange-traded funds that follow gold prices and let investors participate without owning actual gold. These funds buy and store physical gold bullion in secure vaults. Each ETF share equals a specific amount of gold—usually part of an ounce. Some ETFs track gold prices directly, while others invest in gold-mining companies.

Gold ETFs come in four main types:

- Physical Gold ETFs: Invest directly in gold bullion held in vaults

- Gold-Mining ETFs: Track performance of gold-mining company stocks

- Leveraged Gold ETFs: Use derivatives to increase gold returns

- Inverse Gold ETFs: Move opposite to gold prices

How to invest in gold ETFs

The process to invest in gold ETFs is simple and straightforward.

You need to open a brokerage account with a trusted provider that offers ETF trading. Research the gold ETFs by looking at their five-year returns (which should match gold price movements) and expense ratios (usually 0.25% to 0.40%). You can then buy shares through your broker just like any other stock.

Major exchanges list gold ETFs that trade during market hours, making them available to new and seasoned investors alike.

Paper gold vs physical gold: key differences

The main difference between paper gold (ETFs) and physical gold shows up in how you own it. ETF investors own shares that represent gold instead of the metal itself. This means ETF investors depend on fund administrators to meet their obligations.

Gold ETF shares trade throughout market hours with narrow bid-ask spreads, making them highly liquid. Physical gold requires testing, secure storage, and insurance—costs that ETF investors don’t have to worry about.

Services like Bitgolder now help investors convert cryptocurrency into physical gold bullion to broaden their investment mix between digital and traditional assets.

Physical gold vs gold ETF: a detailed comparison

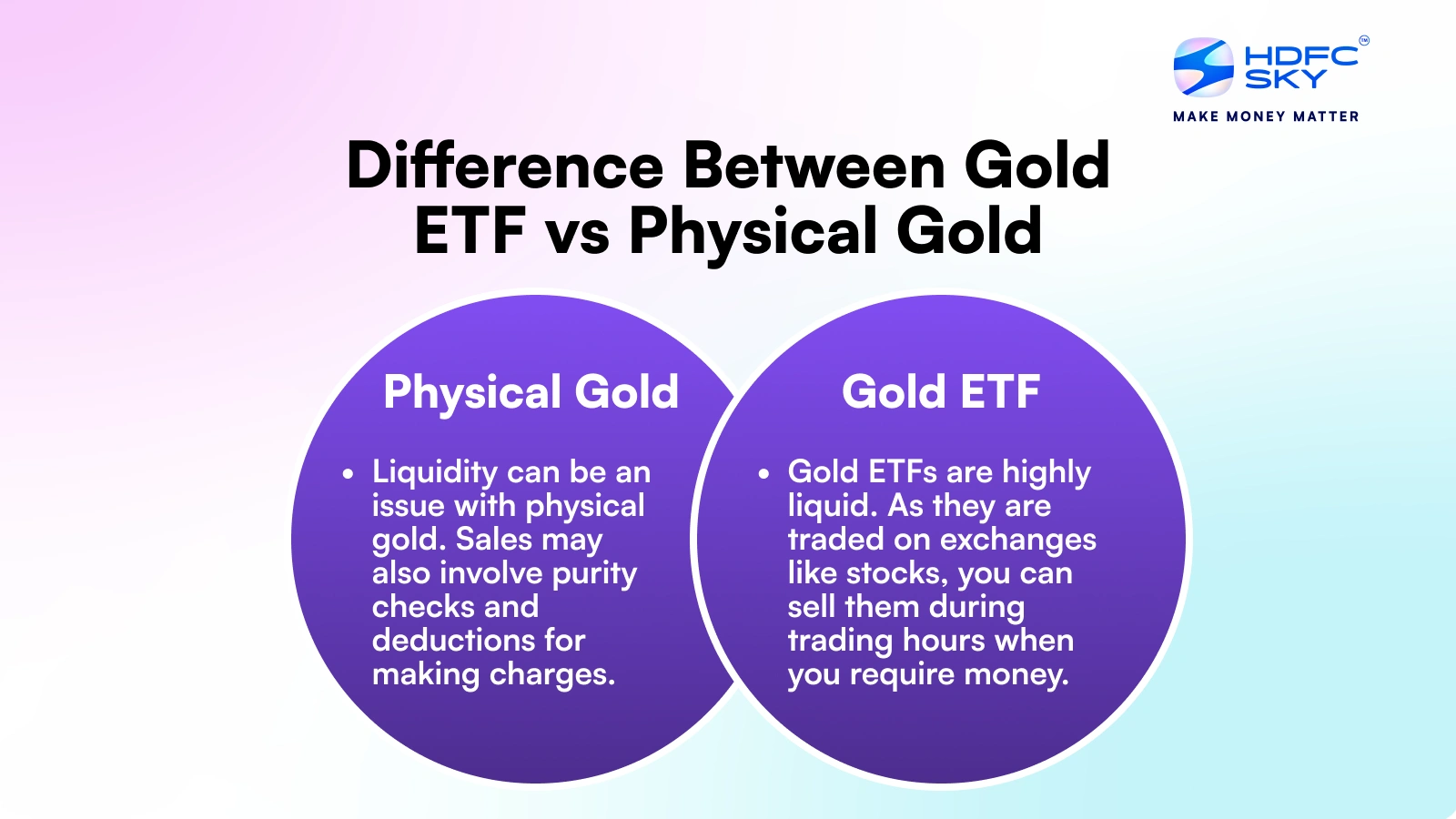

Image Source: HDFC Sky

The choice between tangible assets and digital investment options boils down to several factors. Let’s get into the main differences that might shape your decision in 2025.

Cost and fees: making charges vs fund expenses

Physical gold comes with steep upfront costs. Dealer premiums above spot price and making charges for jewelry can substantially cut into your investment value. Gold ETFs take a different approach with annual expense ratios (usually 0.25% to 0.40%) that slowly eat away at your holdings over time.

Storage and security: home safes vs custodians

Physical gold needs secure storage—you’ll need home safes or bank vaults—plus you might have to pay for insurance. ETFs make life easier since professional custodians handle everything in security.

Liquidity and resale value

Gold ETFs stand out as the most liquid gold investment option. You can trade shares instantly during market hours without burning much money on transaction costs. Physical gold, especially smaller pieces like 1-ounce coins, sells pretty well too but you’ll need to find dealers and might get less than spot value.

Taxation rules for both types

Physical gold owners pay capital gains tax up to 28% as collectibles. Gold ETFs structured as grantor trusts face the same 28% maximum rate.

Loan and collateral options

Banks love both investment types as collateral. You can get loans up to 75% of your physical gold’s value. With gold ETFs, you might need to convert them to physical gold first before securing loans.

Which performs better historically?

In the last five years, physical gold beat Gold ETFs with 20% CAGR compared to 13.8%-14.07% from top ETFs. Cryptocurrency holders can use platforms like Bitgolder to convert their holdings into physical gold bullion.

Choosing the right option for your goals

Image Source: U.S. Money Reserve

Your personal financial goals and risk tolerance determine the best gold investment approach. Several factors need evaluation to find an option that lines up with your investment strategy.

When to choose physical gold

Physical gold works best for investors who want to preserve wealth over decades or pass it to future generations. You might prefer it especially when you have a fondness for tangible assets that you can see and touch – similar to owning investment properties instead of REITs. Many investors head over to physical gold because it exists outside electronic systems, which protects against digital security risks like cyberattacks or technical failures.

When ETFs make more sense

Gold ETFs are ideal for investors who want easy trading and high liquidity. These instruments trade like regular equities on stock exchanges, so investors can adjust their portfolio quickly without worrying about storage or insurance costs. Investors with short-to-medium investment horizons usually find ETFs more practical to capitalize on gold price movements.

Can you combine both for diversification?

A strategy that mixes physical gold and ETFs creates a balanced approach with unique benefits from each type. This combination helps diversify your portfolio effectively. You could put some money in physical gold to hedge against economic uncertainty and use ETFs to take advantage of market fluctuations.

How Bitgolder helps convert crypto to gold

Bitgolder gives cryptocurrency holders a platform to convert digital assets into precious metals. The platform accepts Bitcoin and stablecoins through networks like Ethereum, Arbitrum, Base, and Tron. Their service stands out by offering privacy with anonymous shipping options for orders up to $20,000, and they need minimal customer information.

Conclusion

Your specific investment goals should determine whether you choose physical gold or ETFs instead of looking for a “best” option. Physical gold has proven its worth with an impressive 20% CAGR in the last five years, outperforming ETFs. ETFs give investors easier market access with better liquidity and lower entry costs.

Smart investors often use both approaches to get the best results. This combined strategy lets you keep physical gold as a long-term safety net while using ETFs for quick market moves. Your time frame, security preferences, and need for quick cash should guide your choice.

Services like Bitgolder let cryptocurrency holders vary their investments into precious metals by converting digital assets into physical gold bullion. This creates a bridge between old and new investment worlds for investors who want to protect their portfolios.

Gold prices keep hitting new highs, which makes understanding these investment options crucial. Gold remains a strong way to protect against economic uncertainty whether you pick physical ownership, ETF convenience, or both. The right choice depends on your financial goals and investment style rather than pure profit potential.

Key Takeaways

Understanding the differences between physical gold and ETFs can help you make smarter investment decisions for 2025, whether you prioritize tangible security or trading convenience.

• Physical gold outperformed ETFs historically with 20% CAGR vs 13.8-14% from top ETFs over five years • ETFs offer superior liquidity and convenience, trading instantly during market hours with lower storage costs • Physical gold provides tangible security and wealth preservation but requires secure storage and insurance • Combining both approaches creates balanced diversification – physical gold for long-term security, ETFs for flexibility • Cryptocurrency holders can now convert digital assets to physical gold through platforms like Bitgolder

The optimal choice depends on your investment timeline, security preferences, and liquidity needs rather than seeking a universal “best” option. Many sophisticated investors use hybrid strategies to capture benefits from both investment vehicles.

FAQs

Q1. Is investing in Gold ETFs more profitable than physical gold in 2025? While Gold ETFs offer better liquidity and lower costs, physical gold has historically outperformed ETFs with a 20% CAGR over the past five years compared to 13.8-14% from top ETFs. The best choice depends on your investment goals and risk tolerance.

Q2. Are Gold ETFs a safe investment option for 2025? Gold ETFs are generally considered safe investments as they are managed by regulated fund houses. They offer high liquidity, allowing you to buy or sell during market hours, and are ideal for long-term investors seeking steady growth without the additional costs associated with physical gold.

Q3. What are the prospects for physical gold investment in 2025? The outlook for physical gold remains bullish for 2025 and beyond. Prices are expected to average around $3,675 per ounce by the fourth quarter of 2025, with strong demand from central banks and investors supporting the market.

Q4. How do storage and security differ between physical gold and Gold ETFs? Physical gold requires secure storage solutions like home safes or bank vaults, along with potential insurance costs. Gold ETFs eliminate these concerns as professional custodians handle all security aspects, making them more convenient for many investors.

Q5. Can I combine physical gold and Gold ETFs in my investment portfolio? Yes, many sophisticated investors use a hybrid approach, combining both physical gold and ETFs. This strategy allows you to benefit from the tangible security of physical gold while taking advantage of the liquidity and convenience offered by ETFs, providing a balanced and diversified gold investment portfolio.