Gold vs Cryptocurrency: Which one better for long term investment

Bitcoin reached a historic milestone and topped $100,000 recently, sparking renewed debates between gold and cryptocurrency investors worldwide. The total value shows a stark contrast – cryptocurrency’s market cap stands at roughly $1.895 trillion, while gold commands an estimated $13.7 trillion as of March 2024.

Performance metrics between crypto and gold reveal dramatic differences. Gold prices have climbed 71% in the last five years, yet Bitcoin has delivered an astronomical 1,060% return during that same timeframe. Bitcoin’s volatility tells an interesting story – a 100% surge in early 2021 was followed by a 74% crash the next year. The cryptocurrency bounced back with a 149% gain in 2023 and added another 116% through the first eleven months of 2024.

The U.S. Dollar Index dropped 8% this year, and investors have flocked to both assets. Gold and Bitcoin prices responded with impressive gains of 24% and 18% respectively. This piece will get into gold and cryptocurrency investments from multiple perspectives that could help shape your long-term investment strategy.

Gold and Cryptocurrency: A Brief History

Image Source: Seeking Alpha

Gold has been a symbol of wealth and prosperity throughout human civilization. People have used it in commerce for thousands of years, starting with the Lydians who first minted gold coins around 550 BC. Ancient Chinese traders used gold ingots, which became the foundation of their financial systems. The Gold Standard emerged in the late 19th century and lasted about a hundred years. This system fixed major currencies to gold at a set price per ounce.

Gold as a store of value for centuries

Gold’s lasting value comes from several unique qualities. The metal looks beautiful and exists in quantities that make it perfect for minting coins. Gold doesn’t rust or lose its quality, which makes it perfect to pass wealth down through generations. The lack of gold adds a lot to its value. Here’s a striking fact: workers produce more steel globally in one hour than all the gold ever mined in history.

The rise of cryptocurrency since 2009

Cryptocurrency has a much shorter story. Satoshi Nakamoto, either a person or group, launched Bitcoin as the first digital currency in 2009. This launch came after they published “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008. Bitcoin had almost no value at first. A programmer bought two pizzas for 10,000 Bitcoins in 2010 – those coins would be worth over $600 million at Bitcoin’s peak.

New cryptocurrencies started appearing after Bitcoin’s success. These altcoins tried to improve upon Bitcoin’s original design. Bitcoin reached $20,000 for the first time in 2017. The total cryptocurrency market grew to over $800 billion by early 2018.

Why investors compare crypto vs gold

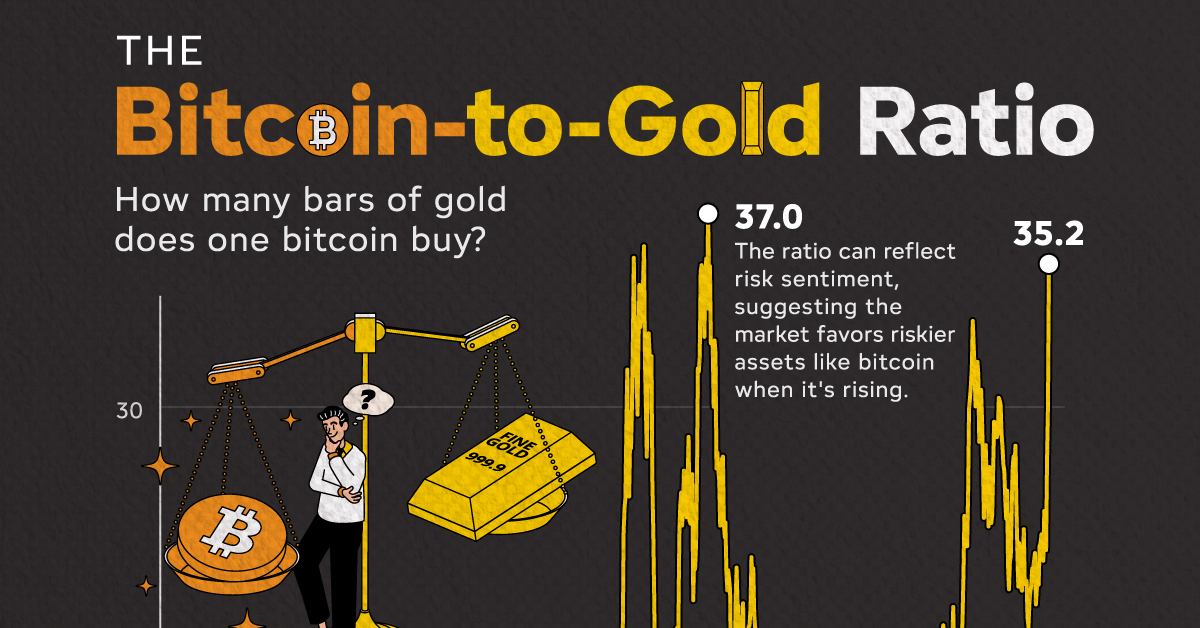

Investors often look at these assets side by side because they work as non-sovereign stores of value. People often compare Bitcoin’s limit of 21 million coins to gold’s natural lack of supply. Both assets help protect against inflation and economic uncertainty.

Investors rush to these assets as safe havens when the economy gets shaky. Both have hit new highs in 2025, but gold has pulled ahead recently. This trend shows that gold still stands strong as the classic safe haven in uncertain times.

Key Differences Between Gold and Cryptocurrency

Image Source: Visual Capitalist

A look at gold vs cryptocurrency as investment options reveals key differences that affect their roles in a portfolio. These differences are vital to make smart investment decisions.

Volatility and price stability

Gold prices stay remarkably stable and move within modest ranges. The price stayed between USD 250-500 per troy ounce from 1981 to 2005. Bitcoin tells a different story with its wild price swings. Bitcoin’s value shot up 100% from January to November 2021, dropped 74% the next year, then surged 149% in 2023 and another 116% through the first eleven months of 2024. The crypto market has calmed down as it matures. Its volatility now sits at 52.2% per year, down from earlier triple-digit levels.

Liquidity and ease of access

Both assets are easy to trade but work differently. Gold sees hundreds of billions in daily trades through regulated exchanges. Physical gold deals need time to verify and deliver. Bitcoin handles hundreds of thousands of trades each day. You can trade crypto any time, day or night, and close deals within minutes. Investors can even buy tiny amounts of crypto with just a few dollars.

Regulation and legal clarity

Gold trades follow rules that are centuries old. These trades happen on highly regulated exchanges that protect consumers. Bitcoin works without central oversight, which makes it great for quick trades but raises security concerns. Many countries see cryptocurrencies as commodities, but rules vary worldwide. The rules keep getting clearer as more people use crypto.

Security and storage methods

Secure vaults or safety deposit boxes hold most gold, and big trades go through regulated exchanges. Bitcoin security depends on cryptographic code. Crypto wallets’ safety depends on their users—poor device security can lead to theft. Keeping crypto offline in cold storage is one of the safest options. Yet thieves still stole USD 1.7 billion in crypto during 2023.

Tax implications for each asset

Each asset faces different tax rules. U.S. investors pay regular income tax on gold sold within a year, while longer holds might qualify for lower capital gains rates. Bitcoin follows similar short-term or long-term capital gains rules. Some places offer better tax deals for cryptocurrency. Long-term Bitcoin investors might save up to 8% on taxes compared to gold investors, since precious metals face higher capital gains rates (28%) than cryptocurrencies (20%).

Pros and Cons of Investing in Gold vs Cryptocurrency

Choosing between gold and cryptocurrency means understanding what makes each investment special. These assets come with their own benefits and risks that attract different types of investors.

Gold: stability, inflation hedge, but low returns

Gold has shown its worth as a safe-haven when the economy gets rough. Gold prices jumped from $1300 in early 2019 to $2100 by mid-2020 during the COVID-19 pandemic. Its value comes from many sources – central banks keep it as reserves, while companies use it to make electronics and jewelry. This mix of uses helps gold stay strong when other investments struggle.

Gold does have its limits though. Between 1971 and 2024, it brought in yearly returns of 7.98%, which falls short of the stock market’s 10.70%. Most experts say you should put just 3-6% of your money in gold, based on how much risk you can handle.

Crypto: high growth potential, but high risk

Bitcoin and other cryptocurrencies could make you a lot of money. Bitcoin has outperformed every other type of investment worldwide in seven of the last ten years. But this opportunity comes with big risks. Bitcoin’s price swings up and down based on news coverage, what investors think, and changes in regulations.

On top of that, cryptocurrency faces some unique problems. There’s uncertainty about regulations, risk of scams, and environmental issues. Bitcoin mining uses more than double the power of all home lighting in the U.S.. Plus, cryptocurrency has no real value beyond what investors think it’s worth.

Gold vs cryptocurrency volatility comparison

These assets move very differently in price. Gold bounces around by about 15.5% yearly, while Bitcoin jumps by 52.2%. Bitcoin has calmed down quite a bit from its earlier days when price swings were even bigger.

Market troubles affect them differently too. Take March 2020 – Bitcoin crashed more than 40% and ended up down 25% that month. Gold dropped 8% at first but bounced back fast.

Gold vs cryptocurrency investment comparison

Both assets might protect you from inflation, but they do it differently. Gold gives you stability when times get tough, while Bitcoin might make you more money if you’re willing to take the risk.

Here’s something interesting – putting some gold in your crypto portfolio might actually help balance things out. Big investment firms now see these assets working together instead of competing. They know each one plays its own part in spreading out investment risk.

Which Is Better for Long-Term Investment?

Image Source: TradingView

Your personal circumstances will determine whether gold or cryptocurrency is right for you. Let’s take a closer look at what could work best in your portfolio.

Investor risk tolerance and goals

Your risk appetite and investment objectives will guide your choice between gold and cryptocurrency. Gold makes more sense if you want to preserve capital, protect against inflation, and minimize risk. Gold’s annual volatility stays around 12-15%. Bitcoin might be a better fit if you seek growth potential and can handle sharp price swings.

Diversification strategy: combining both

These assets create better results when used together. Many wealthy investors now embrace both options – 38% own gold and 31% have crypto investments. Expert financial advisors suggest putting 5-10% of your portfolio in gold to protect against inflation, and 1-5% in cryptocurrency to stimulate growth. This combination can help balance your returns since each asset responds differently to economic changes.

Gold vs cryptocurrency chart: performance over time

Both assets reached new highs in 2025, but their performance is different. Bitcoin and gold have each delivered about 28% returns through July 2025. Gold’s total market value ($22.6 trillion) remains much larger than Bitcoin’s ($2.4 trillion).

Is gold better than cash or crypto for long-term?

Gold has proven better than cash for wealth preservation over centuries. History shows that gold maintains or increases its value during economic downturns. Gold continues to show its strength during inflation, recessions, and global uncertainty.

Conclusion

The choice between gold and cryptocurrency as a long-term investment depends on your financial goals and risk tolerance. Gold’s millennia-long track record provides stability and consistent performance during economic uncertainty. Bitcoin shows extraordinary growth potential paired with high volatility. It achieved 1,060% returns over five years while gold gained 71% during the same period.

Financial experts recommend a balanced approach. It makes strategic sense to see both assets as complementary rather than competitive. Most wealth advisors suggest putting 5-10% of your portfolio in gold to protect against inflation and maintain stability. They also recommend a smaller 1-5% position in cryptocurrency for growth potential.

Bitcoin’s price swings remain pronounced, yet its volatility has dropped from triple-digit levels to the current 52.2%. This figure is nowhere near gold’s modest 15.5% volatility, which shows the fundamental difference between these investment options.

These assets respond differently to economic triggers. Gold serves as a steady wealth preserver during market downturns. Cryptocurrency often amplifies broader market trends, though not always predictably.

This isn’t a binary choice. Many wealthy investors now hold both assets – 38% own gold and 31% hold cryptocurrency. This diversification strategy helps investors benefit from gold’s stability while taking part in cryptocurrency’s growth potential.

Your investment horizon, age, and financial situation should shape your allocation decisions. Younger investors with decades until retirement might handle higher cryptocurrency exposure. Those nearing retirement might prefer gold’s proven stability. Understanding both assets’ distinct characteristics helps build a resilient long-term investment portfolio.

Key Takeaways

When deciding between gold and cryptocurrency for long-term investment, understanding their distinct characteristics and risk profiles is essential for making informed portfolio decisions.

• Gold offers stability with modest returns – Gold provides consistent inflation protection and wealth preservation with 15.5% volatility, but delivers lower average annual returns of 7.98% compared to stocks.

• Bitcoin delivers explosive growth with high risk – Cryptocurrency achieved 1,060% returns over five years versus gold’s 71%, but comes with extreme volatility at 52.2% and significant regulatory uncertainty.

• Diversification strategy works best – Financial experts recommend combining both assets: 5-10% portfolio allocation to gold for stability and 1-5% to cryptocurrency for growth potential.

• Risk tolerance determines optimal choice – Conservative investors seeking capital preservation should favor gold, while growth-focused investors with high risk tolerance may prefer cryptocurrency exposure.

• Both serve as inflation hedges differently – Gold acts as a traditional safe haven during economic uncertainty, while Bitcoin offers modern digital scarcity with 24/7 liquidity and fractional investment access.

The most successful approach involves treating these assets as complementary rather than competitive, allowing investors to benefit from gold’s proven stability while participating in cryptocurrency’s revolutionary growth potential.

FAQs

Q1. Is gold or cryptocurrency a better long-term investment? Both have their merits. Gold offers stability and consistent performance during economic uncertainty, while cryptocurrency provides higher growth potential with increased risk. The best choice depends on your risk tolerance and financial goals. Many experts recommend a diversified approach, allocating 5-10% to gold and 1-5% to cryptocurrency in a balanced portfolio.

Q2. How has Bitcoin’s performance compared to gold over the past decade? Bitcoin has significantly outperformed gold in terms of returns. Over the past five years, Bitcoin has seen a 1,060% increase, while gold has risen by 71%. However, Bitcoin’s volatility is much higher at 52.2% compared to gold’s 15.5%, making it a riskier investment.

Q3. What are the key differences in volatility between gold and cryptocurrency? Gold demonstrates much lower volatility, with an annualized rate of about 15.5%. In contrast, Bitcoin’s volatility stands at 52.2%, though this has decreased from earlier triple-digit levels. This difference in volatility reflects the relative stability of gold compared to the more unpredictable nature of cryptocurrency.

Q4. How do gold and cryptocurrency differ in terms of regulation and security? Gold benefits from centuries of established regulatory frameworks and is traded through highly regulated exchanges. Cryptocurrency operates without central regulatory oversight, which can be both an advantage and a concern. Gold is typically stored in secure vaults, while cryptocurrency security relies on cryptographic code and proper management of digital wallets.

Q5. Can gold and cryptocurrency be effectively combined in an investment portfolio? Yes, many investors and financial experts recommend combining both assets for a balanced approach. Gold can provide stability and inflation protection, while cryptocurrency offers growth potential. A common suggestion is to allocate 5-10% of a portfolio to gold and 1-5% to cryptocurrency, allowing investors to benefit from gold’s stability while participating in cryptocurrency’s potential upside.